Why Multi-Factor Authentication is Not Enough

Knowing is half the battle, and the use and abuse of common frameworks shed insight into what defenders need to do to build defense in depth.

September 13, 2024 - Blog

Credit unions sit at a unique crossroads: you’re expected to deliver “big bank” digital convenience with “community institution” resources... and threat actors know it. As member-facing services expand (including mobile banking, instant payments, online lending, and fintech integrations), cyber risk grows alongside it.

The good news is that most successful attacks on credit unions rely on a handful of repeatable weaknesses: identity gaps, third-party exposure, incomplete visibility, and controls that don’t keep pace with modern fraud and ransomware tactics.

Credit unions manage high-value data (PII, account information, loan documents) and high-trust transactions. That mix draws two categories of threat actors:

Fraud operators looking for account takeover, payment diversion, or business email compromise (BEC).

Ransomware and extortion groups aiming to disrupt operations and pressure leadership into fast decisions.

The scale of cyber-enabled fraud is substantial. The FBI’s latest Internet Crime Complaint Center (IC3) annual report reported over $16 billion in reported losses, highlighting how fraud continues to dominate the threat landscape.

Credit unions face a variety of mounting cyber risks, including:

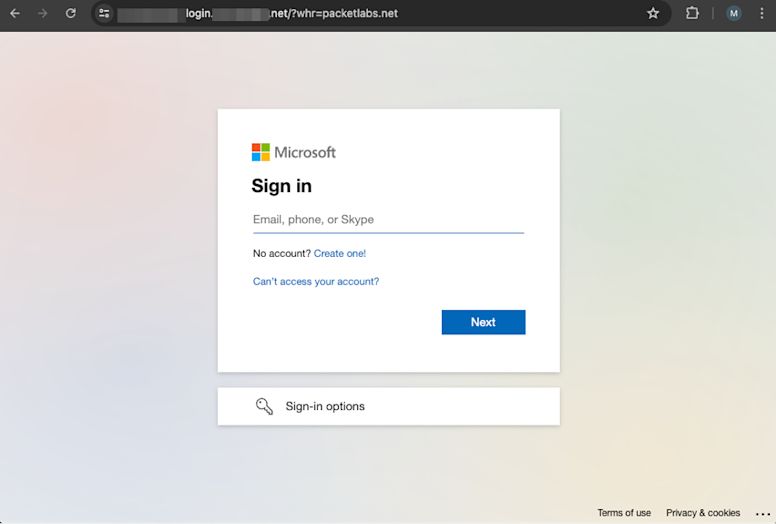

If your members and staff authenticate through cloud IdPs, single sign-on (SSO), VPN, and remote access tools, attackers don’t need to “break in”: they just need to log in. Common pathways include:

Help desk social engineering (password resets, SIM swaps)

Token theft and session hijacking

Weak conditional access and over-permissioned accounts

For credit unions, identity attacks are especially dangerous because they can lead directly to unauthorized transfers, exposure of member data, and privileged access to core systems.

Credit unions increasingly rely on vendors for core banking, digital banking, marketing automation, collections, call center tooling, and IT services. That creates a larger “blast radius” when vendors are compromised.

A recent example of this is Marquis Software Solutions, which disclosed a breach impacting dozens of banks and credit unions: a reminder that vendors can become the entry point even when your internal controls are strong.

Ransomware isn’t only about encryption anymore. Many groups now prioritize data theft and extortion, meaning even strong backups don’t fully eliminate the risk. For financial institutions, downtime is uniquely painful: member trust, branch operations, call centers, origination workflows, and time-sensitive payments are all affected.

Industry reporting continues to show financial services remain heavily targeted by ransomware operators.

Most modern member experiences are powered by APIs: namely mobile apps, fintech connectors, integrations, and partner platforms. That expands the attack surface beyond traditional “web app vulnerabilities” into:

Broken object-level authorization (BOLA)

Account enumeration

Abuse of transfer limits or loan workflows

Token reuse and improper session handling

API abuse is difficult to catch with traditional scanning alone because it often depends on how the system behaves, not just what it exposes.

Credit unions also have to operate under close regulatory scrutiny, demonstrating governance, controls, and measurable maturity. The FFIEC Cybersecurity Assessment Tool (CAT) is being sunset (removed) as of August 31st, 2025, which means institutions should plan how they’ll demonstrate preparedness using updated resources.

NCUA also provides an Information Security Examination and Cybersecurity Assessment resource that credit unions can use to assess readiness and map controls back to recognized standards.

Credit unions don’t need “more tools” as much as they need better security outcomes. The most cost-effective improvements usually fall into five buckets:

Harden identity first: phishing-resistant MFA where possible, conditional access, JIT admin, strict helpdesk verification scripts, and credential-stuffing defenses.

Control vendor blast radius: limit vendor access, enforce segmentation, require security attestations/notification timelines, and test vendor-connected pathways.

Prepare for extortion (not just ransomware): assume data theft, practice decision-making, tighten egress monitoring, and validate backups + restore processes.

Test what scanners miss: focus on attack paths, privilege escalation, and business logic abuse across apps/APIs and identity workflows.

Operationalize measurement: continuously track your control maturity and evidence for exams/audits—even as frameworks evolve.

Credit unions win on trust. Cybersecurity is now part of that promise—because members don’t separate “digital experience” from “data protection.” The most resilient credit unions treat security as a continuous program: identity-centered, vendor-aware, operationally prepared, and validated through realistic testing that mirrors real attacker behavior.

Speak with an Account Executive